Minimum withdrawal 401k calculator

To make paperwork easier you can also have the taxes withheld from your distribution 10 will automatically be held for federal taxes if you choose this option but you can elect to have. If you withdraw money from your traditional IRA before age 59 12 theres a 10 early withdrawal penalty and that is in addition to the income tax due on each withdrawal.

How To Calculate Rmds Forbes Advisor

So for example if you cash out 10000 from your 401k and youre in the 22 percent federal tax bracket youll pay a total of 3200 in.

. Youll report the taxable part of your distribution directly on your Form 1040. For people under the age of 59½ a hardship withdrawal or early withdrawal from your 401k is allowed under special circumstances which are on the IRS Hardship Distributions pageUsing your 410k for a down payment on a principal residence is. How does a 401k withdrawal affect your tax return.

Any withdrawal made from your 401k will be treated as taxable income and subject to income taxes in the year in which you made it before or after retirement. If you are an owner of an inherited IRA your distribution requirements depend on whether you were a. Retirement Plan and IRA Required Minimum Distributions FAQs.

The IRS generally requires automatic withholding of 20 of. Review the required minimum distribution rules for certain retirement plans including traditional IRAs SEP IRAs SIMPLE IRAs and 401k. Also unlike the Roth IRA it has required minimum distributions RMD at age 72 though at that stage.

Free annuity calculator to forecast the growth of an annuity with optional annual or monthly additions using either annuity due or immediate annuity. Tax On A 401k Withdrawal After 65 Varies. Early 401k withdrawals will result in a penalty.

Or you can use a calculator like this one from T. Youll also be subject to a 10 early distribution penalty if youre younger than age 59 12 at the time you take the withdrawal. At age 72 federal law requires you withdraw a minimum amount from most retirement savings accounts.

This 401k distribution calculator is very simple and all it asks is that you enter your account balance at the end of the last year. You die or become permanently disabled. However you can take.

This is the amount of money that you must withdraw every year from the 401k account. These payments must last a minimum of 5 years or until you reach the normal 401k withdrawal age of 59 12 whichever is shorter. Use the Calculator Inherited IRAs.

How To Calculate Required Minimum Distribution For An Ira. Taxes will be withheld. On your Form 1040.

31 for the year following the year you turn 70½ or 72 if born after June 30 1949. The 401k has become a staple of retirement planning in the US. Whether youve reached retirement age or need to tap your 401k early to pay for an unexpected expense there are various ways to withdraw money from.

Substantially Equal Period Payments SEPP might be a good option if you need to withdraw money for a long term need. If you return the cash to your IRA within 3 years you will not owe the tax payment. Exceptions for Both 401k and IRA.

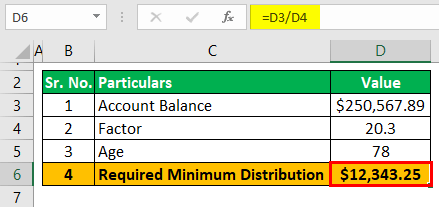

By pressing the calculate button we get two values. If your employer does not offer 401k loans they may still offer a 401k withdrawal. When you cash out your 401k before the age of 59 ½ youll be required to pay income tax on the full balance as well as a 10 percent early withdrawal penalty and any relevant state income tax.

For traditional 401ks there are three big consequences of an early withdrawal or cashing out before age 59½. You can make a one-time also known as lump-sum withdrawal or a series of withdrawals or schedule automatic withdrawals. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules.

Use our RMD Calculator to find the amount of your RMD based on your age account balance beneficiaries and other factors. Millions of Americans contribute to their 401k plans with the goal of having enough money to retire comfortably when the time comes. You can make your first withdrawal by December 31 of the year you turn 70½ or 72 if born after June 30 1949.

While you still have to pay taxes on any money taken out of a 401k or IRA before a certain age there are some circumstances that would let you get around the 10 early withdrawal penalty for retirement funds. Once you start withdrawing from your 401k or traditional IRA your withdrawals are taxed as ordinary income. Whatever you take out of your 401k account is taxable income just as a regular paycheck would be when you contributed to the 401k your contributions were pre-tax and so you are taxed on withdrawals.

If you were born on or after 711949 your first RMD will be for the year you turn 72. An RMD is the annual Required Minimum Distribution that you must start taking out of your. You can make a penalty-free withdrawal at any time during this period but if you had contributed pre-tax dollars to your Traditional IRA remember that your deductible contributions and earnings including dividends interest and capital gains will be taxed as ordinary income.

Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Early Withdrawal Costs Calculator. 401K and other retirement plans.

Rowe Price to estimate your distribution you must take a minimum amount but you can always take out more. The 2 trillion CARES Act wavied the 10 penalty on early withdrawals from IRAs for up to 100000 for individuals impacted by coronavirus. Individuals will have to pay income taxes on withdrawals though you can split the tax payment across up to 3 years.

Required Minimum Distribution Calculator. Individual retirement accounts have slightly different withdrawal rules from 401ks. Exceptions to the Early Withdrawal Penalty.

Once you reach age 59½ you can withdraw funds from your Traditional IRA without restrictions or penalties. IRA FAQs - Distributions Withdrawals Internal Revenue Service. Publication 590-B Distributions from Individual Retirement Arrangements IRAs Internal Revenue Service.

So you might be able to avoid that 10 401k early withdrawal penalty by converting your 401k to an IRA. IRAs or 401ks please visit the Retirement Calculator Roth IRA Calculator IRA Calculator or 401K Calculator. Required Minimum DistributionsCommon Questions About IRA Accounts Internal Revenue Service.

Or early withdrawal penalties implemented by the IRS reduce liquidity. The SECURE Act of 2019 changed the age that RMDs must begin. Use this calculator to help determine your withdrawal amount.

Rmd Table Rules Requirements By Account Type

Debt Free With An Early 401k Withdrawal 401k Debt Debtpayoff Early Free Withdrawal Debt Payoff Plan Credit Card Debt Payoff Debt Free

Here S How To Calculate Your Required Minimum Distribution From A Traditional Ira Or 401 K The Motley Fool The Motley Fool Personal Finance Printables Student Debt Required Minimum Distribution

We Have 25 Years Until Retirement And Are Saving 25 Of Our Income Are We Doing It Right In 2022 Personal Savings Retirement Calculator Certified Financial Planner

Rmd Calculator Required Minimum Distributions Calculator

Rmd Table Rules Requirements By Account Type

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

News You Should Know Irs Changing Rmd Rules For 2022 Pera On The Issues

Rrif Withdrawals How To Calculate Your Rate Moneysense

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Required Minimum Distribution Calculator Estimate The Minimum Amount

Fee Calculator Amp Hidden Fees Analyzer Tool Personal Capital Calculator Mutuals Funds Person

Taxtips Ca Rrsp Rrif Withdrawal Calculator

Retirement Withdrawal Calculator For Excel

Required Minimum Distribution Calculator Estimate The Minimum Amount

Did I Just Retire At Age 52 Video In 2022 White Coat Investor Retirement Planning Early Retirement

Required Minimum Distribution Calculator Estimate The Minimum Amount